Navigating The Fiscal Landscape: A Comprehensive Guide To The 2026 Tax Calendar

Navigating the Fiscal Landscape: A Comprehensive Guide to the 2026 Tax Calendar

Related Articles: Navigating the Fiscal Landscape: A Comprehensive Guide to the 2026 Tax Calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Fiscal Landscape: A Comprehensive Guide to the 2026 Tax Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Landscape: A Comprehensive Guide to the 2026 Tax Calendar

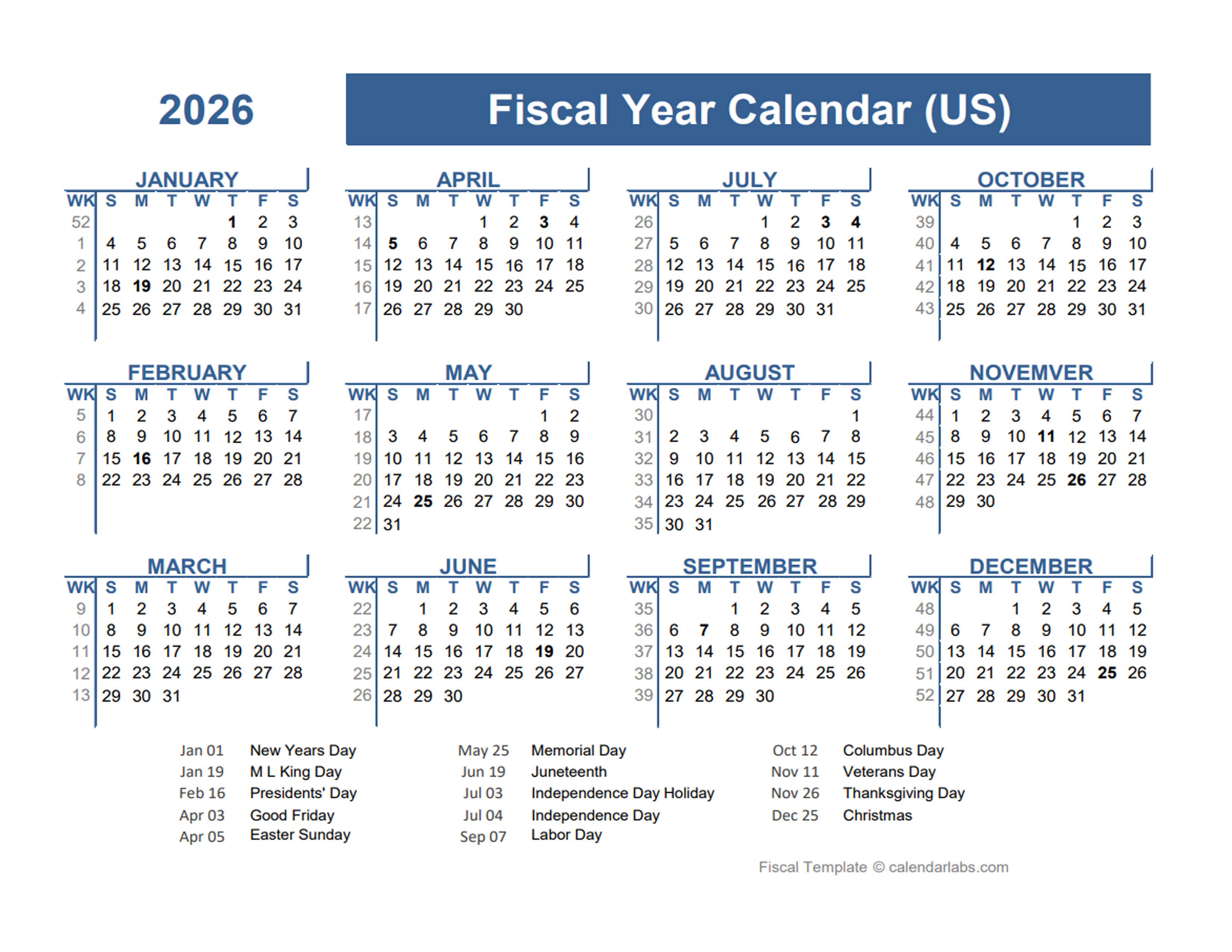

The 2026 tax calendar, a vital tool for individuals and businesses alike, outlines the critical deadlines for fulfilling tax obligations. This calendar serves as a roadmap, ensuring timely compliance with tax regulations and avoiding potential penalties.

Understanding the Importance of the 2026 Tax Calendar

The 2026 tax calendar is a crucial resource for several reasons:

- Organization and Planning: It provides a clear overview of upcoming tax deadlines, allowing taxpayers to plan their financial activities effectively.

- Avoiding Penalties: Timely compliance with tax obligations is paramount. The calendar helps avoid late filing and payment penalties, which can significantly impact financial well-being.

- Financial Management: By understanding the tax calendar, individuals and businesses can manage their finances effectively, ensuring sufficient funds are available to meet tax liabilities.

- Compliance with Regulations: The calendar reflects the latest tax regulations and ensures adherence to legal requirements.

Key Elements of the 2026 Tax Calendar

The 2026 tax calendar typically includes:

- Tax Filing Deadlines: The calendar specifies the deadlines for filing various tax returns, such as income tax returns, corporate tax returns, and property tax returns.

- Payment Deadlines: It highlights the due dates for paying taxes, including income tax installments, property tax installments, and other tax liabilities.

- Important Tax Events: The calendar may also include information on other tax-related events, such as the release of new tax forms, changes in tax regulations, and tax audits.

Navigating the 2026 Tax Calendar: A Step-by-Step Guide

- Obtain a Copy of the Calendar: The tax calendar is typically published by the relevant tax authority. It is available online or in printed format.

- Review and Understand the Deadlines: Carefully review the calendar and note all relevant deadlines for filing returns and making payments.

- Plan Accordingly: Based on the deadlines, create a financial plan to ensure timely compliance with tax obligations.

- Stay Updated: Tax regulations can change frequently. It is crucial to stay informed about any updates or amendments to the tax calendar.

FAQs: Addressing Common Concerns about the 2026 Tax Calendar

Q: What happens if I miss a tax deadline?

A: Missing a tax deadline can result in penalties, including late filing penalties and late payment penalties. The severity of the penalties can vary depending on the specific situation and the tax authority.

Q: Can I extend the deadline for filing my tax return?

A: In some cases, it is possible to request an extension for filing your tax return. However, this does not extend the deadline for paying your taxes. An extension only provides additional time to file the return, not to pay the tax liability.

Q: How do I know if my tax return is correct?

A: It is always advisable to seek professional guidance from a tax advisor or accountant to ensure the accuracy of your tax return. They can help you understand your tax obligations and ensure compliance with all relevant regulations.

Tips for Optimizing Tax Compliance in 2026

- Maintain Accurate Records: Keep meticulous records of all financial transactions, including income, expenses, and investments.

- Seek Professional Advice: Consult with a qualified tax advisor or accountant for guidance on tax matters.

- Stay Informed: Stay updated on any changes to tax laws or regulations.

- Plan for Tax Liabilities: Factor in tax obligations when making financial decisions.

- File on Time: Avoid penalties by filing your tax return and paying your taxes by the deadlines.

Conclusion

The 2026 tax calendar plays a crucial role in navigating the complex world of taxation. By understanding its importance, key elements, and practical tips, individuals and businesses can ensure timely compliance, avoid potential penalties, and manage their financial resources effectively. Staying organized, seeking professional advice, and staying informed about tax regulations are essential steps in achieving successful tax compliance.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Landscape: A Comprehensive Guide to the 2026 Tax Calendar. We thank you for taking the time to read this article. See you in our next article!